Samuel is a product leader and two-time founder, currently serving as VP of Product at Fivestars. He previously founded Divvyshot (acquired by

Facebook) and co-founded Freshplum (acquired by TellApart).

Leading up to Facebook’s acquisition of Instagram, I was the product manager in charge of Facebook Photos. Mark Zuckerberg had bought my previous company, Divvyshot, one of the first iOS photo-sharing apps. I worked closely with Mark, and so conversations about the future of social sharing and emerging mobile apps were common. Instagram was a competitor that came up more than once.

Now that attorneys general in 48 states and the Federal Trade Commission are suing Facebook for their acquisition of Instagram, you might imagine I have a strong opinion about it. I do, both as the former Facebook Photos PM and as a former Facebook acquisition. In some ways, I was the appetizer for the eventual entrée. As an American consumer, I know success for the FTC would unequivocally be a disaster for innovation.

A key question in this antitrust case is whether Facebook bought Instagram to eliminate a competitive threat. Documents have already leaked suggesting Mark perceived Instagram as a threat. That same sentiment felt clear to me in our conversations.

I wasn’t at Facebook for long. In my mid-twenties and with a rush of confidence, I decided to leave to start another company. In hindsight, I left abruptly and without much notice. I departed soon after kicking off an initiative to revamp our mobile Photos products, leaving the team in a lurch (the mobile rehaul never launched). Months later, Mark started to court Instagram. The deal was formalized exactly one year after my sudden departure.

We have to be sophisticated about what we call a monopoly and how we constrain (or punish) our country’s most successful businesses.

Despite those events suggesting anti-competitive intent, I’m simply not convinced that the recent antitrust suit will benefit the competitive startup ecosystem or even consumers as a whole.

A cliché phrase in the startup space is “thinking from first principles,” but in this case, it’s helpful. The primary reason the United States government wants to regulate monopolies is to “protect competition and benefit consumers.” In the recent antitrust suit against Facebook, they are ostensibly protecting Facebook’s competitors in the startup ecosystem.

There are two key pieces of legislation that Facebook has been accused of violating. First, the Sherman Act, which makes it unlawful to maintain or acquire a monopoly, and then the Clayton Act, which goes a step further in prohibiting anti-competitive, monopolistic mergers and acquisitions.

The sine qua non of an antitrust accusation — violating Section 2 of the Sherman Act, which Facebook is accused of — is being able to prove that a company has used their monopoly to “harm society by making output lower, prices higher, and innovation less than would be the case in a competitive market.” The Department of Justice also establishes that a major factor in qualifying a monopoly is if a company has had “a market share in excess of two-thirds for a significant period.”

Before looking at Facebook, let’s look at an example of successful antitrust action. Critics of Facebook often bring up United States v. Microsoft Corp. as precedent. In this case, Microsoft was accused of a monopoly stemming from its bundling of Internet Explorer with Windows. To be clear, I agree with this antitrust action because Microsoft had a monopoly. If you examine Microsoft’s market share for operating systems in 1998, they owned 86% of the market when the case was filed. It is easy to see how they used unreasonable bundling to artificially grow market share for Internet Explorer, clearly making “output lower” and “innovation less” (does anyone look back fondly at Internet Explorer?) for society.

It’s much harder to see where exactly Facebook has a monopoly. For instance, the FTC is suing Facebook to divest Instagram. Instagram’s revenue is primarily generated from advertisers on the platform. The FTC’s accusation of monopoly — with their fingers pointed at Instagram — would imply that Facebook has built a dominant share of the digital advertising market. However, market research company EMarketer found that Facebook had 23% of this market in 2020, a far cry from two-thirds control. Calling Facebook a monopoly is far from a cut-and-dry case.

Now let’s ask the question: Who actually benefits from this antitrust action?

Not the founder of the next Facebook-killer. With the FTC pressing the heel of their boot down on acquisitions, it becomes less rewarding — and riskier — to found a startup.

In Silicon Valley, every new founder is an aspiring disruptor. But they and their investors understand the value of the cliché, “if you can’t beat them, join them.” I understood that reality when I sold Divvyshot to Facebook in 2010, shortly after my bank account hit $0.

Without the prospect of rich acquisitions by major companies, fewer founders would risk their livelihood and venture capital dollars would shrink. Large technology companies would be incentivized to simply copy newcomer products, rather than acquire their teams. Don’t forget: Being acquired is a success for most startups and entrepreneurs (who often lack other appealing outcomes).

Not the consumer. For the consumer to benefit, one has to believe that either (a) Instagram would have been more successful without Facebook, or (b) Facebook’s behavior discourages other competitive startups.

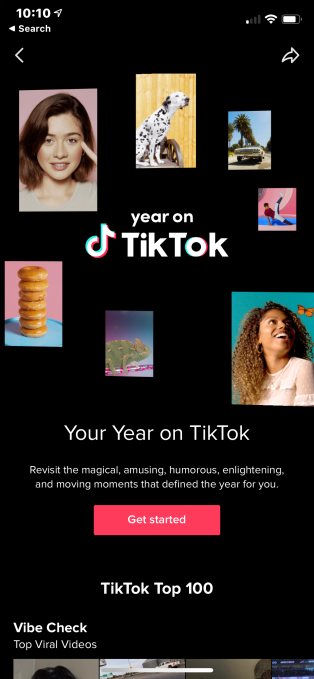

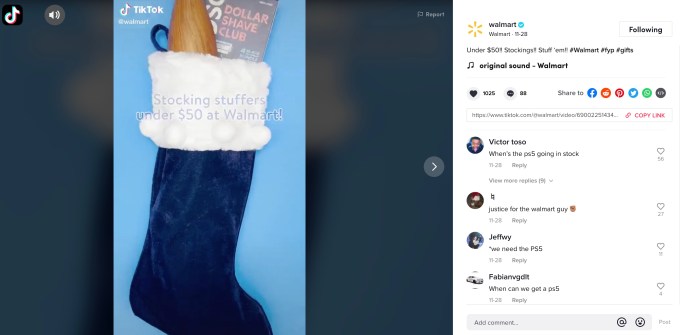

The former has been well-debated and is a somewhat subjective question. For the latter, with a shrinking pool of dollars and founders comes a shrinking pool of competition in any category. It’s that competition that fuels a busy home screen with a dozen app icons for every use case. Instagram’s $1 billion exit encouraged copycats, competitors and innovators like Vine, Flipagram, VSCO, and, eventually, TikTok.

As Mark Zuckerberg said about their acquisitions, “One way of looking at this is that what we’re really buying is time.” It’s hard to stay on the top in tech. If dot-com history is any indication, today’s leaders will be tomorrow’s Yahoo. It’s that natural pressure of age, not the threat of antitrust, that encourages companies like Facebook to make innovative product bets in new categories like VR to avoid irrelevance.

It’s time for a new plan. To be clear, we must foster competition within our technology space here in the United States. We should explore entirely new versions of antitrust legislation that focus on affirmative outcomes rather than punitive assessments.

The U.S. government might consider accommodating acquisitions by these companies through ecosystem development. Rather than shutting down acquisitions, consider a requirement that the acquirer invests some percentage of any significant acquisition amount into blind minority positions at other emerging startups.

It’s a dramatic thought, but new dynamics might emerge with innovation as the clear winner. For instance, these technology giants may fund startups that undermine their entrenched competitors. One example: Facebook might use this venture arm to fund ideas outside their scope in the Future of Work, creating insurgent competition for Microsoft.

The outflow of capital from incumbents to startups would foster competition while still enabling incumbents to scale. Remember, it’s these scale effects that allow us to enjoy our low consumer prices, high quality of life and R&D-fueled innovation that no economy wants to lose.

There’s a more important monopoly at stake. Silicon Valley is the most competitive and innovative sector in the world. Regions and governments across the globe aspired to copy our “secret sauce,” but often have been hampered by regulation, corruption or anti-capitalistic legislation. Are we sure it’s time for us to start copying them?

Up until recently, that question was just hypothetical. Silicon Valley’s title as the leader in innovation was never under threat. We had the protective moats of geographic density, well-functioning capital markets, light-touch regulation and permissive immigration policy (50% of Silicon Valley startups are founded by immigrants, after all). Are we sure we don’t want to double-down on that winning formula?

Meanwhile, China has liberalized its economy. Shenzhen, China’s hub for technology innovation, has had its gross domestic output (GDP) grow by an annual average of 20.7% over the last 40 years, even recently surpassing Hong Kong. I find the recent dethroning of Facebook by TikTok as the most downloaded application worldwide in 2020 a foreboding sign.

While nobody would choose to give personal data to foreign companies ruled by autocratic regimes, most users aren’t weighing those consequences as they scroll through the next social experience. After all, who among us isn’t tempted to make that trade-off for an engaging TikTok video in the middle of a quarantine?

We have to be sophisticated about what we call a monopoly and how we constrain (or punish) our country’s most successful businesses. We may pick a battle with Facebook and win, but lose the larger war. Losing that war may mean pushing the next Instagram out of Silicon Valley.

And that may mean, somewhat ironically, that the only technology monopoly the United States government is dismantling with this flavor of antitrust legislation is its own.

from Social – TechCrunch https://ift.tt/38pVfsR

via

IFTTT

Need to get someone's attention fast? Honk them! They'll get a notification to come to the chat. If it's super important, you can spam the Honk button — that's hard to miss.

Need to get someone's attention fast? Honk them! They'll get a notification to come to the chat. If it's super important, you can spam the Honk button — that's hard to miss.  With Magic Words, you can assign any emoji to any word or phrase, which automatically trigger effects as you type. It's the best way to personalize your chats and bring them to life. Set up to 50 unique Magic Words per chat!

With Magic Words, you can assign any emoji to any word or phrase, which automatically trigger effects as you type. It's the best way to personalize your chats and bring them to life. Set up to 50 unique Magic Words per chat!