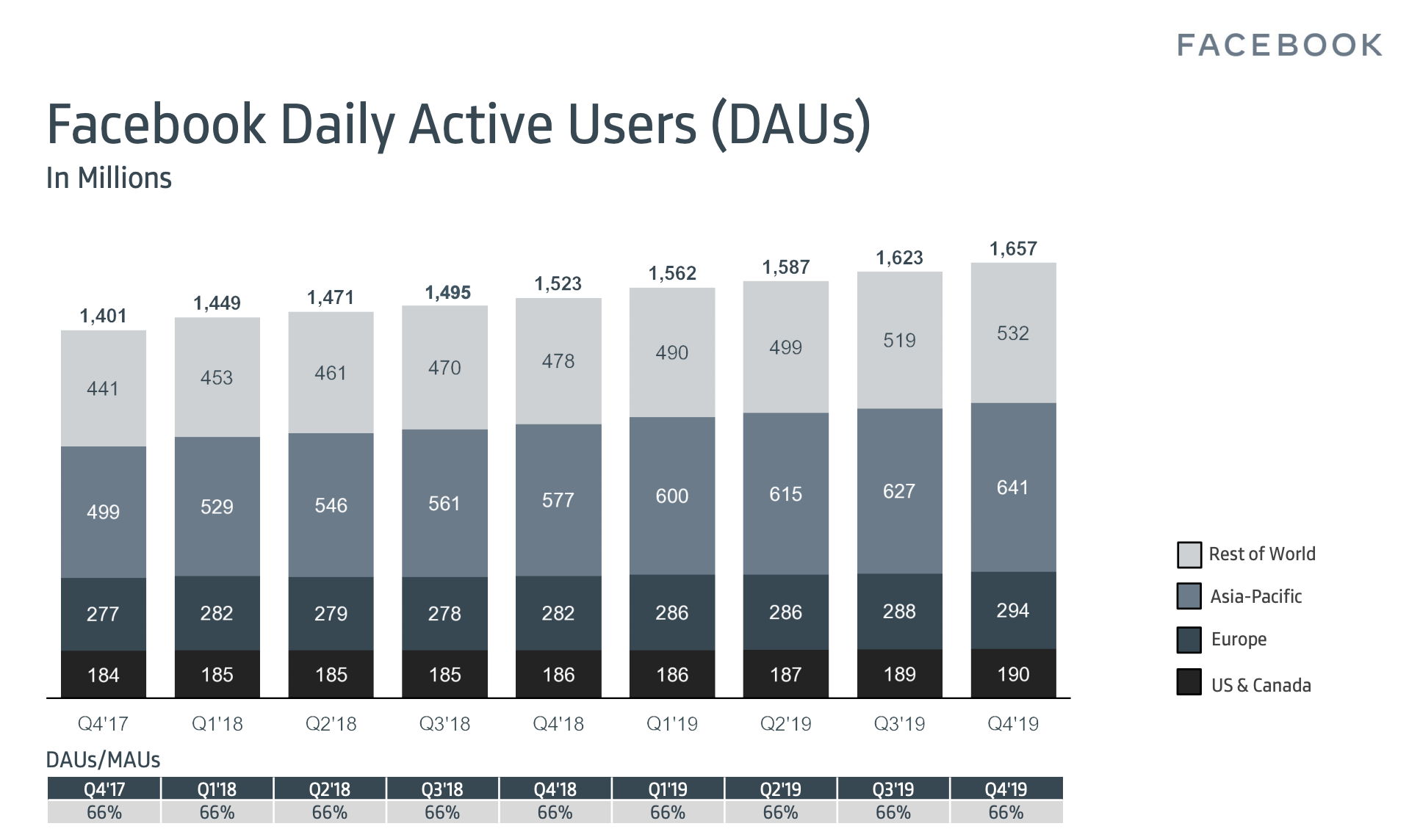

Facebook beat Wall Street estimates in Q4 but slowing profit growth beat up the share price. Facebook reached 2.5 billion monthly users, up 2%, from 2.45 billion in Q3 2019 when it grew 1.65%, and it now has 1.66 billion daily active users, up 2.4% from 1.62 billion last quarter when it grew 2%. Facebook brought in $21.08 billion in revenue, up 25% year-over-year, with $2.56 in earnings per share.

But net income was just $7.3 billion, up only 7% year-over-year compared to 61% growth over 2018. Meanwhile, operating margins fell from 45% over 2018 to 34% for 2019. Expenses grew to $12.2 billion for Q4 2019, up a whopping 34% from Q4 2018. For the year, Facebook’s $46 billion in expenses are up 51% vs 2018. One big source of those expenses? Headcount grew 26% year-over-year to 44,942.

While Facebook’s user base keeps growing rather steadily, it’s having trouble squeezing more and more cash out of them with as much efficiency.

Facebook’s earnings beat expectations compared to Zack’s consensus estimates of $20.87 billion in revenue and $2.51 earnings per share. Facebook shares fell over 5% in after-hours trading following the earnings announcement after closing up 2.5% at a peak $223.23 today. Still, Facebook remains above all previous share price highs before this month.

Facebook CEO Mark Zuckerberg had previously warned that addressing hate speech, election interference, and other content moderation and safety issues would be costly. Still, expenses grew and profits shrunk faster than Wall Street seems to have expected. Facebook will have to hope its promise of using scalable AI to handle more of these jobs comes to fruition soon. But some might see today as the proper reckoning for Facebook — penance for years of neglecting safety in favor of growth.

Facebook’s executives are apparently bullish on its value despite the share price being at a peak, as today Facebook announced plans to grow its share-repurchase program by $10 billion, adding to its previous authorization of buying back up to $24 billion worth.

Facebook managed to add 1 million daily users in the U.S. & Canada region where it earns the most money after returning to growth there last quarter following a year of slow or no growth. Facebook’s stickiness, or daily to monthly active user ratio remained at 66% amidst competition from apps like TikTok and a resurgent Snapchat.

Facebook notes that there are now 2.26 billion users that open either Facebook, Messenger, Instagram, or WhatsApp each day, up from 2.2 billion last quarter. The family of apps sees 2.89 billion total monthly users.

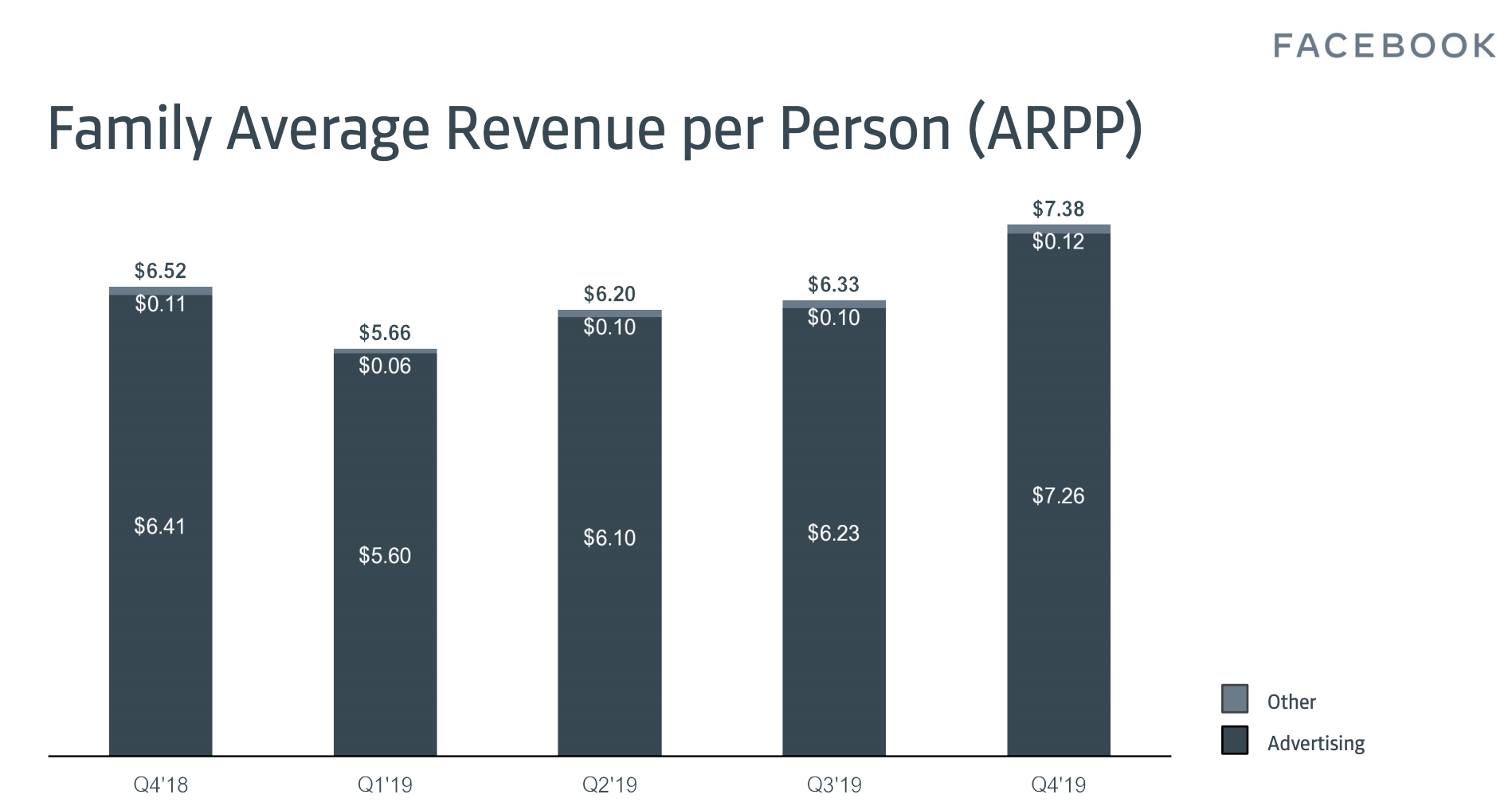

Facebook released a new stat with this earnings report: Family Average Revenue Per Person. That’s essentially the company’s total revenue divided by total users on Facebook, Messenger, Instagram, and WhatsApp. Clearly, the company is trying to use Instagram’s growing ad revenue to make the rest of the company look stronger. This might help mask changes in the Facebook app’s own revenue as teens look to more youthful content feeds.

The business aside, Facebook had another tough quarter under the scrutiny of journalists and regulators. Democratic presidential candidates have railed against CEO Mark Zuckerberg’s decision to continuing allowing misinformation in political ads. The company dropped out of the top 10 places to work, and pledged $130 million to fund an Oversight Board for its content policies. The FTC continued its anti-trust investigation and weighed an injunction that would halt Facebook intermingling its messaging app infrastructure.

But those headwinds didn’t stop Facebook’s march forward. Its four main apps took the top four spots amongst the most downloaded apps of the 2010s. It’s acquiring gaming companies like Playgiga and the studio behind VR hit Beat Saber. And its share price remains at an all-time high despite today’s tumble. While the world may be increasingly uncomfortable with Facebook’s access to private data, there’s no debate about how incredibly valuable that data is.

from Social – TechCrunch https://ift.tt/37D5rN7

via IFTTT

0 comments:

Post a Comment